CarbonCount®

“Investors need to measure the efficiency with which capital is reducing climate change, which is why we use a straightforward ratio to measure the GHG reduction per dollar of investment. The concept is simple: if carbon counts and capital is scarce, we ought to prioritize the most impactful investments for mitigating climate change.”

Jeffrey W. Eckel

Executive Chair

Measuring the Climate Impact of Every Investment

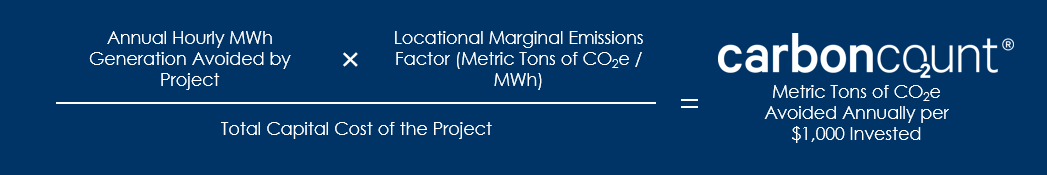

CarbonCount is a proprietary scoring tool for evaluating real assets to determine the efficiency by which each dollar of invested capital avoids annual carbon emissions (CO2e).

Methodology

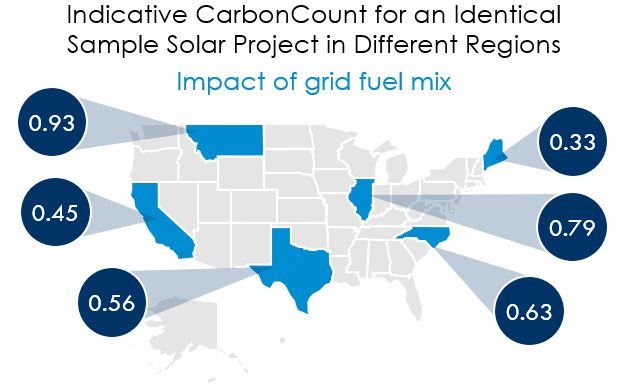

Starting in 2023, HASI updated the CarbonCount methodology to utilize location-specific hourly grid emissions factors, known as locational marginal emissions factors, where available.

CarbonCount Helps

| 1. | Investors assess and compare opportunities for quantifiable carbon impact |

| 2. | Developers site projects to maximize carbon impact |

| 3. | Corporate buyers ensure that the projects with which they contract more accurately mitigate the carbon impact of their consumption |

| 4. | Policymakers spur the regulations and infrastructure required to achieve net zero targets |

| 5. | Other stakeholders detect and prevent greenwashing and hold all of us accountable for our quantified carbon impact |

The Value of CarbonCount Reporting

Key Differentiators

Comparability: An intentionally simplified solution to a complex problem produces a concise and comparable metric of avoided carbon emissions

Transparency: Illustrating the true cost and potential impact of clean energy and infrastructure investments gives investors and stakeholders confidence in project performance

Accountability: A simple metric removes the ambiguity of what is implied by the words “green” and “sustainable” for more objective, credible reporting

Impact: CarbonCount encourages capital flow to the most impactful climate-mitigating building and energy infrastructure projects