Sustainability and Impact Leadership

Our Approach to Sustainability and Impact

Since 2013, we have embedded purpose into our corporate vision: Every investment improves our climate future. Integrating this purpose into our business model allows us to quantify both downside exposure and upside opportunities – all in support of delivering meaningful long-term value and impact.

Our thoughtful and rigorous approach to Sustainability and Impact embraces the concept of double materiality, focusing on both issues most material to our business and those externalities our business most impacts.

Impact Metrics

>8 million

Cumulative metric tons of carbon dioxide (CO2) avoided annually through our investments, the equivalent to eliminating emissions from over 1.7 million passenger vehicles

>7 billion

Cumulative gallons of water saved annually from our investments, the equivalent to eliminating the annual water consumption of over 171,000 U.S. homes every year

~400,000

Quality jobs created by our investments across the U.S

~300,000

School children supported by our energy efficiency upgrades to educational facilities and bus fleets funded by our investments

~2 Million

Veterans served by hospitals and other facilities that received energy efficiency upgrades funded by our investments

Sustainable Development Goals

The United Nations Sustainable Development Goals (SDGs) represent the biggest and most complex challenges of our time. At HASI, we prioritize the following SDGs that are most relevant to our expertise, business objectives and corporate citizenship goals:

2024 Sustainability & Impact Highlights

~$2.3 billion

invested in climate

solutions

Published Green Bond

Framework

Recognized

as A List by CDP for

third consecutive year

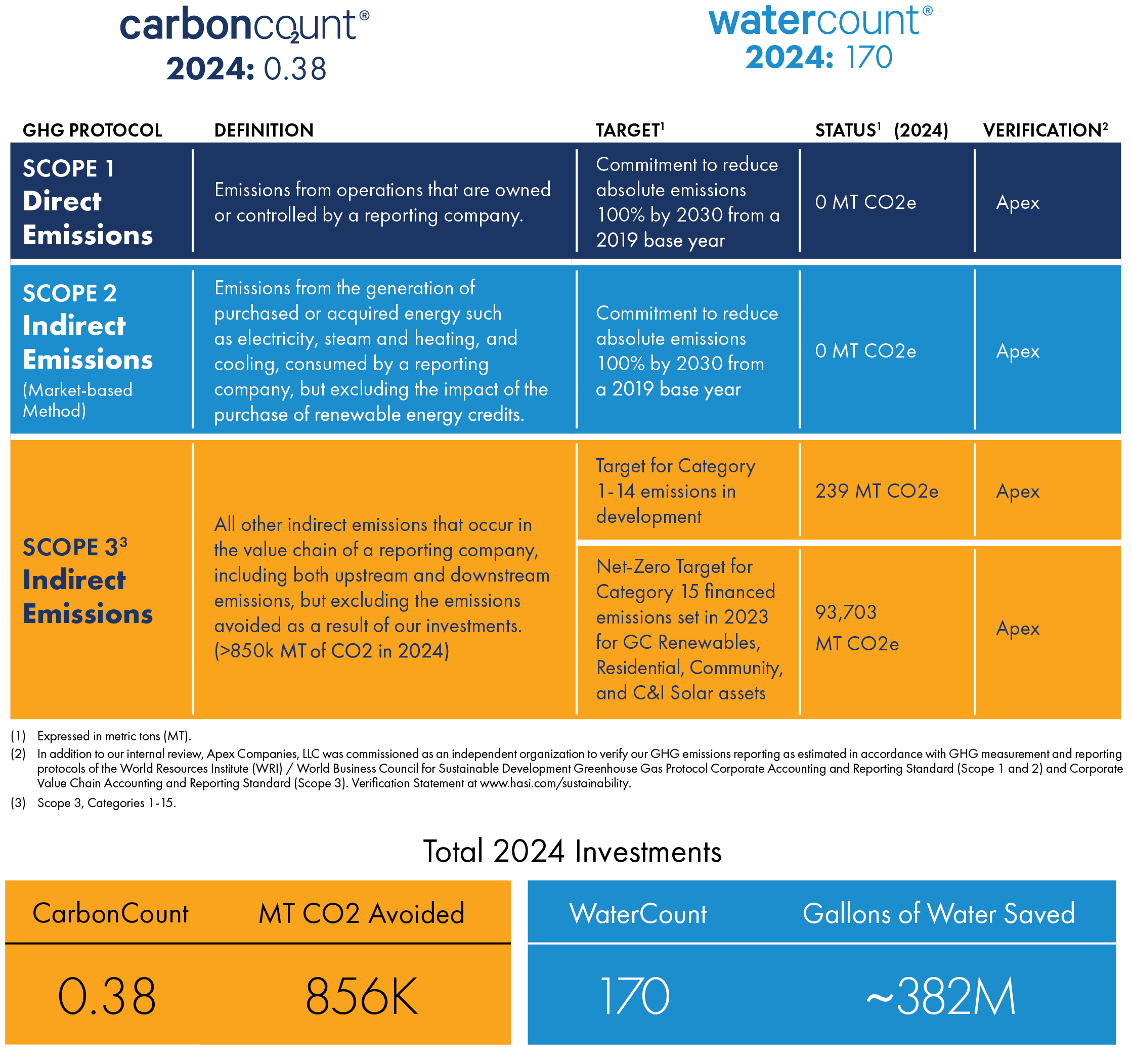

856k MT1 of incremental

annual reductions in

carbon emissions

Obtained “Dark Green”

Second-Party Opinion (SPO)

on Green Bond Framework

>$2.4m

Social Dividend declared to

support HASI Foundation

Continued to support “Emissions

Matching” for GHG Protocol

Scope 2 update

1) Metric Tons

Sustainability and Impact Governance

We recognize the importance of incorporating, evaluating and monitoring sustainability-related opportunities and risks as integral components of our overarching vision and strategy. HASI’s Board is charged with officially adopting our Sustainability and Impact (S&I) policies and monitoring S&I risks and opportunities. The Nominating, Governance and Corporate Responsibility Committee (NGCR) assumes a pivotal role in consistently reviewing our strategies, activities, policies and disclosures on a quarterly basis. This comprehensive review encompasses key documents such as our Sustainability Investment Policy, Environmental Policies, Code of Business Conduct and Ethics, Human Rights Statement and Human Capital Management Policies. Through this robust S&I governance structure, we affirm our steadfast commitment to remaining aligned with our objectives.

![]()

HASI Board of Directors

Nominating, Governance, and Corporate Responsibility Committee

President and CEO

Cross- Functional S&I Leadership Team

Transformative Giving

The HASI Foundation was created to add a long-term strategic lens to our maturing corporate philanthropy efforts targeted at the intersection of climate action and social justice. This effort flowed from an organic expression of shared values that fits naturally within our culture of fierce curiosity and rigor about outcomes in climate investing.

The foundation is funded by annual Social Dividends declared by HASI and the proceeds from an internal price on carbon assessed against HASI’s Scope 1, 2 and 3 emissions (net of the avoided emissions resulting from investments). HASI has contributed more than $9 million to the Foundation since its inception.

HASI Foundation Vision

We seek to accelerate a just transition toward an equitable, inclusive and climate positive future.

Focus Areas

Climate Solutions for Disadvantaged Communities

Support for organizations providing direct access to affordable energy efficiency, renewable energy and health-enhancing products and services to low-to-moderate income households and disadvantaged communities

Climate Solutions

Career Pathways

Support for programs targeted at historically underrepresented communities and communities impacted by climate change and/or the energy transition that provide education on climate change impacts and training for careers in climate solutions

Local

Impact

Support for organizations across the District of Columbia, Maryland and Virginia region that strengthen the social fabric and promote economic and climate resilience

Policies & Disclosures

HASI’s sustainability policies, principles, and reporting disclosures aspire to the highest ethical standards.

For additional information, view our Policies and Disclosures page.

Download PDF

Download PDF